- CartHustle by The Merchant

- Posts

- 💧Liquid I.V.

💧Liquid I.V.

READ TIME: 2MIN. For the third year running, Liquid I.V. ranked as one of Prime Day’s top-selling products climbing to #3 in 2025.

Happy Tuesday!

Someone asked if SEO still matters in the age of ChatGPT. Told them: only if you want to be found.

This week, the AI visibility game gets rewritten, Temu faces U.S. headwinds, and BNPL proves it’s more than a payment perk it’s make-or-break. Plus, Prime Day winners, payment behavior shifts, and a reminder that good retention beats one-day surges.

Let’s dive in! 🚀

ECOMMERCE AI AND SEO

Google Now Feeds ChatGPT — What That Means for Your SEO

Forget Bing. ChatGPT is indexing the web through Google now.

Two SEO tests confirmed it: ChatGPT pulled content from a newly created, unlinked page submitted to Google Search Console, bypassing Bing entirely. The model also referenced Google’s cached snippets in replies.

This changes the AI visibility playbook:

Indexation matters more than rankings ChatGPT pulls from indexed pages, not necessarily top-ranked ones

Pages “Crawled but not indexed” = invisible to LLMs

Improve internal linking (related products, categories, etc.) to boost indexation

Use unique content no copy-paste product descriptions

Structure content clearly with headings, FAQs, and Schema.org markup

Disable JavaScript rendering where possible AI crawlers can’t process it

Takeaway: GenAI uses different rules than SEO. If you want to show up in ChatGPT or Gemini, focus on clarity, structure, and indexation not just page rank.

SPONSORED BY GUIDDE

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

ECOMMERCE NEWS

Temu’s U.S. Ambitions Hit an Amazon-Sized Wall

Temu’s growth in the U.S. is collapsing and Amazon’s price pressure might be the final blow.

After losing tariff exemptions and pausing ad spend in June, Temu’s monthly U.S. app users dropped 54% in just four months. Now, third-party sellers are warning Temu: don’t undercut Amazon on branded products or else.

Here’s what’s driving the stall:

Amazon’s scale allows it to match or beat Temu on price and absorb losses longer

Sellers are being told to avoid pricing the same items cheaper on Temu

U.S. tariffs and the end of “de minimis” imports raised Temu’s cost structure

Temu’s response? Lower seller fees, paused (then resumed) ads, and public calls for open competition

Analysts say PDD would need to lose billions annually to keep up and may not be willing

Takeaway: Competing with Amazon on price alone won’t work. Temu needs differentiated products or an entirely new value proposition to survive the U.S. ecommerce war.

ECOMMERCE TRENDS

How Liquid I.V. Cracked Prime Day Again

For the third year running, Liquid I.V. ranked as one of Prime Day’s top-selling products climbing to #3 in 2025.

That’s ahead of Amazon’s own Fire TV Stick. And it wasn’t luck. It was supply chain readiness, product timing, and full-funnel execution.

Here’s how the hydration brand pulled it off:

Same-day delivery kept inventory flowing during heatwave-driven demand spikes

Subscription model drove repeat purchases and shelf-stocking urgency

New flavor drop (Orange Vanilla Dream) tied to July 4th promos boosted visibility

Amazon influencer activations like GRWM + “Shop with Me” expanded reach

Retention-first strategy kept their CRM, SMS, and email funnel working in sync

💡 Half of Liquid I.V.’s Prime Day buyers in 2024 were new.

But as VP Aaron Jones said: “The real success comes from years of brand building.” Prime Day might bring the spotlight but staying power is built all year.

ECOMMERCE TRENDS

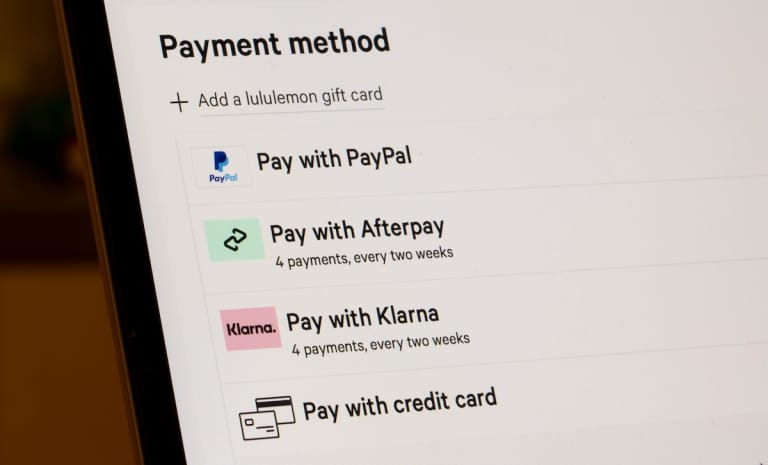

BNPL or Bust: 43% Won’t Buy Without It

Buy Now, Pay Later isn’t just a nice-to-have it’s a dealbreaker.

A new PYMNTS Intelligence report finds that 43% of consumers abandon purchases entirely if BNPL isn’t available, while another 42% downgrade their cart to cheaper alternatives.

Here’s why this matters to ecommerce:

BNPL spans income + age groups, but skews heaviest among 25–34-year-olds (1 in 4 use it)

Top providers: Klarna (26.2%), Afterpay (21.9%), Affirm (19.3%) dominate U.S. market share

35% of users would delay paying other bills just to complete a purchase with BNPL

Most users also carry credit cards — but still choose BNPL for convenience or cash flow gaps

Missed payments range between 23–27%, flagging risk alongside rapid adoption

Takeaway: If BNPL isn’t in your checkout flow, you’re likely leaving money on the table — especially with Gen Z and Millennial buyers.

ECOMMERCE DIGITAL PAYMENTS

Where Consumers Swipe: Debit In-Store, Credit Online

Consumers don’t just shop differently online vs in-store they pay differently too.

A new PYMNTS report shows that channel matters more than age when it comes to payment preferences. Debit dominates physical retail. Credit and wallets lead online.

Here’s what the data says:

50% more likely to use debit in-store than credit

27% more likely to use credit than debit online

Digital wallets: used twice as often online (16%) vs in-store (8%)

Amazon owns 53% of online credit card transactions

Walmart captures 23% of in-store debit shoppers — and leads brick-and-mortar

Temu shoppers skew heavily toward credit card users; Walmart appeals to debit users online and offline

💡 Takeaway: Payment preference is tied to budget, trust, and channel experience.

If you're optimizing checkout flows, tailor payment options to channel + audience behavior — or risk drop-off.

ADVERTISE WITH US

Want to get in front of 5,200+ sharp eCommerce minds?

CartHustle is where brand builders, marketers, and DTC founders stay ahead.

Reach the people moving carts and markets.

Signing off,

The Merchant @CartHustle